Understanding Prorated Subscription Charges

Your Office Puzzle subscription is billed based on the number of active users in your account, charged at a per-user, per-month rate. To reflect actual account usage, we apply prorated billing when users are added or removed during the month.

This guide explains how proration works and how you can manage your account to keep your billing accurate and aligned with your team’s structure.

What is Prorated Billing?

Prorated billing means that when a user is added or deactivated partway through the month, your invoice will reflect only the portion of the month that the user was active.

It’s important to note that active refers to whether the user is enabled in your account—not whether a user logged in or used the platform.

Example: How We Calculate Charges

Let’s say your subscription rate is $19.99 per user/month. The per-day rate is calculated by dividing the monthly rate by the actual number of days in that month.

For example, in a 30-day month:

- $19.99 ÷ 30 = $0.666 per day

- A user active for 5 days → $3.33

- A user active for 10 days → $6.66

- A user active for 21 days → $13.99

In a 31-day month, the per-day rate would be slightly lower:

- $19.99 ÷ 31 = $0.645 per day

Charges are automatically calculated based on each user’s activation and deactivation dates, using the actual calendar days in the billing month.

Best Practices for Accurate Billing

To ensure your subscription charges reflect your team’s current structure:

- Activate users only when needed. Billing starts the day a user is marked active in your account.

- Deactivate users promptly when access is no longer required. Charges stop accruing on the deactivation date.

Keeping your user list current helps maintain a clear, accurate billing experience. For guidance on profile management, see our activation/deactivation tutorial. If you have any questions or need support managing users, we’re here to help.

Mastering Billing with Batch Claims

Name: Create Batch claims

Description: How to create a batch claim within Office Puzzle.

Difficulty: Middle

Duration: Less than 7 minutes

https://www.youtube.com/watch?v=OnGJmXzQo1A

Batch claims

Summary:

Step 1- From the Agency Dashboard, access Billing.

Step 2- Click on Batch Claims.

Step 3- Click on +New Batch.

Step 4- Select Payer.

Step 5- Select Health Plan.

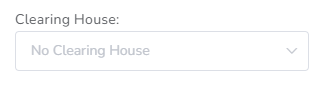

Step 6- Select Clearing House (if needed/required).

Step 7- Click on Create.

Step 8- Within the batch, click on + Add claim.

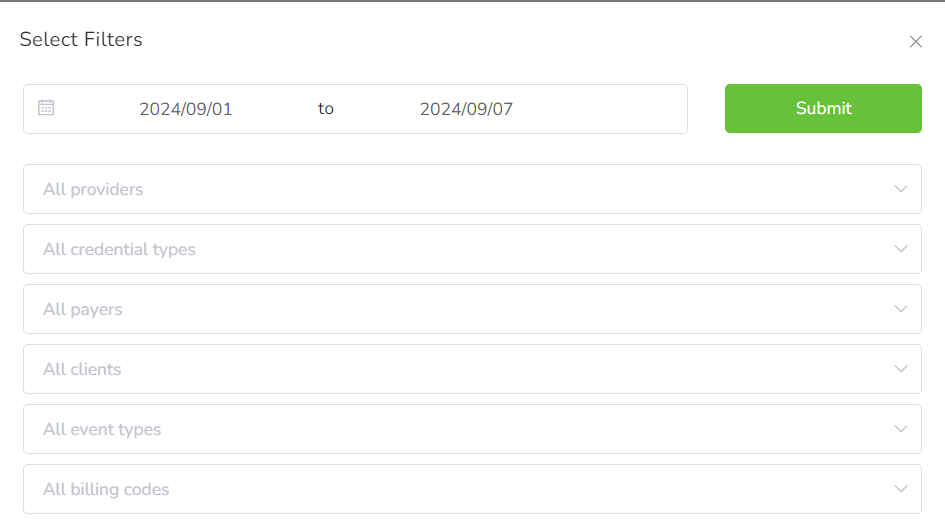

Step 9- Select Other Claims / Events / Manual.

Step 10- If selected Events, then choose the Range of dates and click on Submit. Also, there are Optional filters: Providers, Credential types, Payers, Clients, Event types and Billing codes.

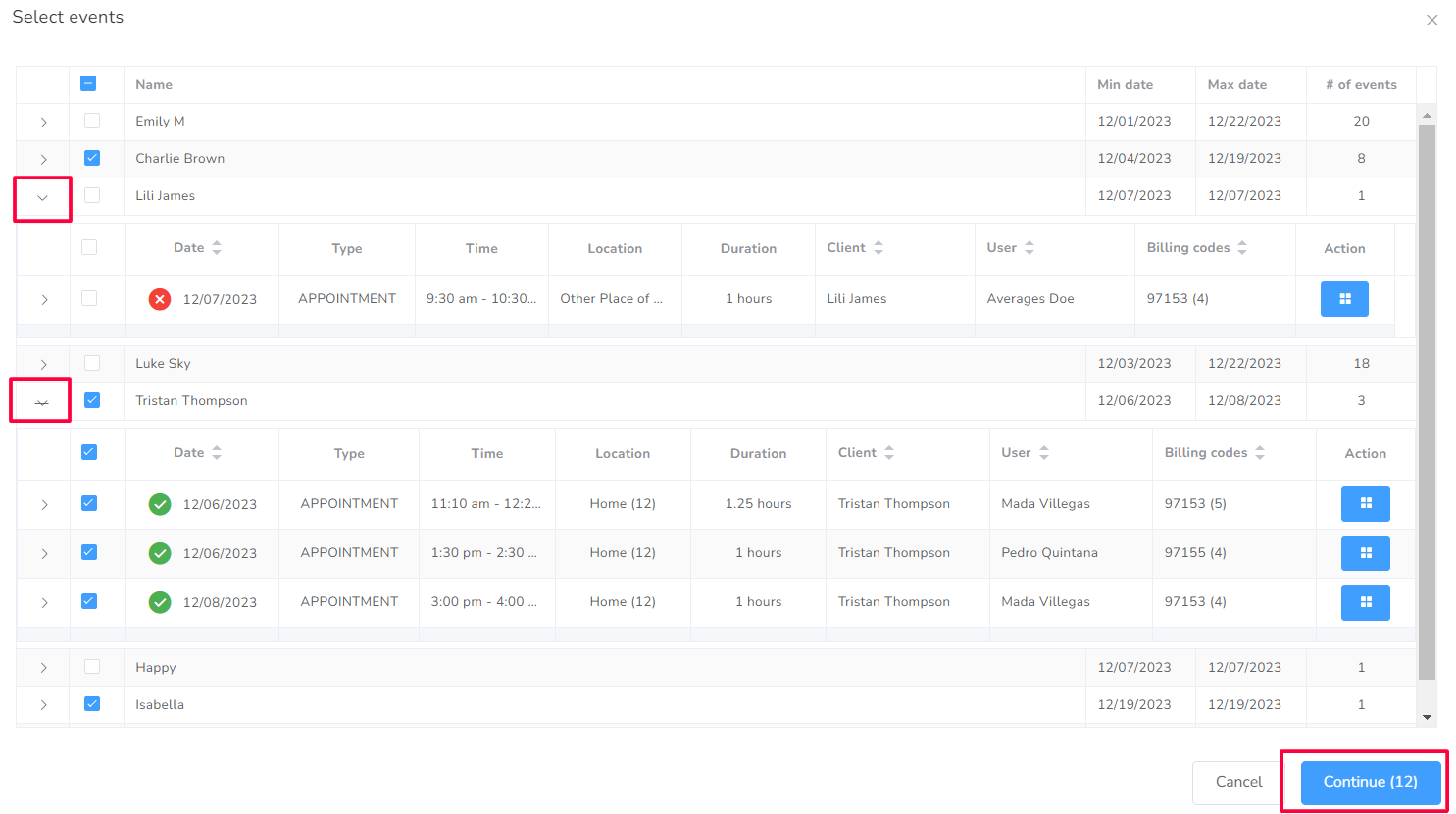

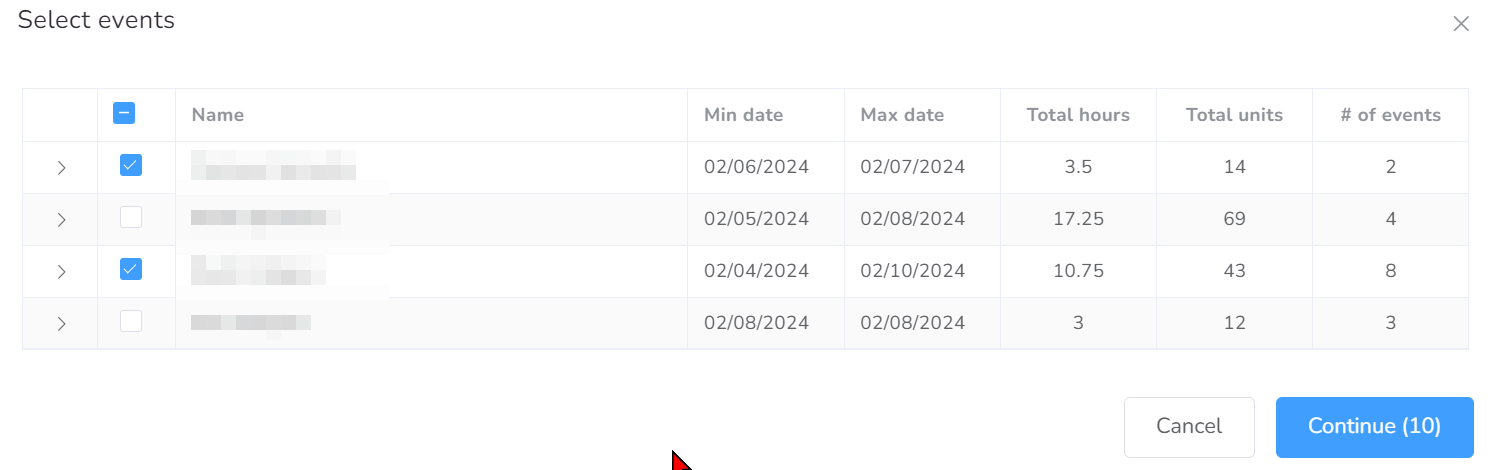

Step 11- Select the events to be included and hit Continue. (There you can check if there are any error on the events)

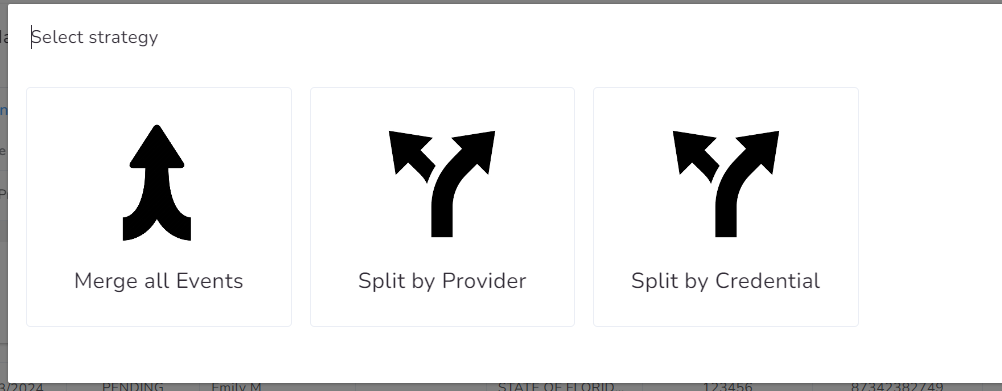

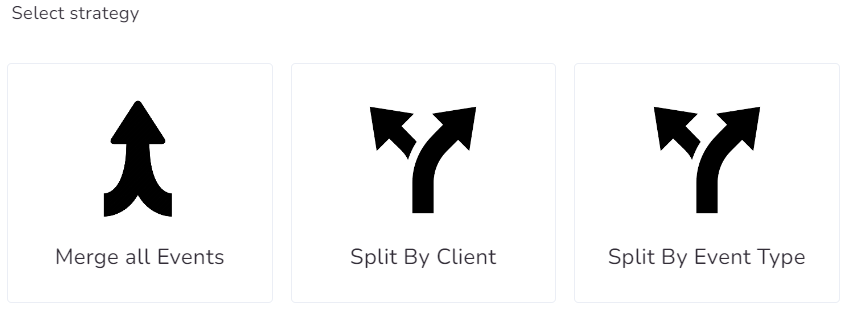

Step 12- Select Strategy: Merge all events, Split by Provider or Split by credential.

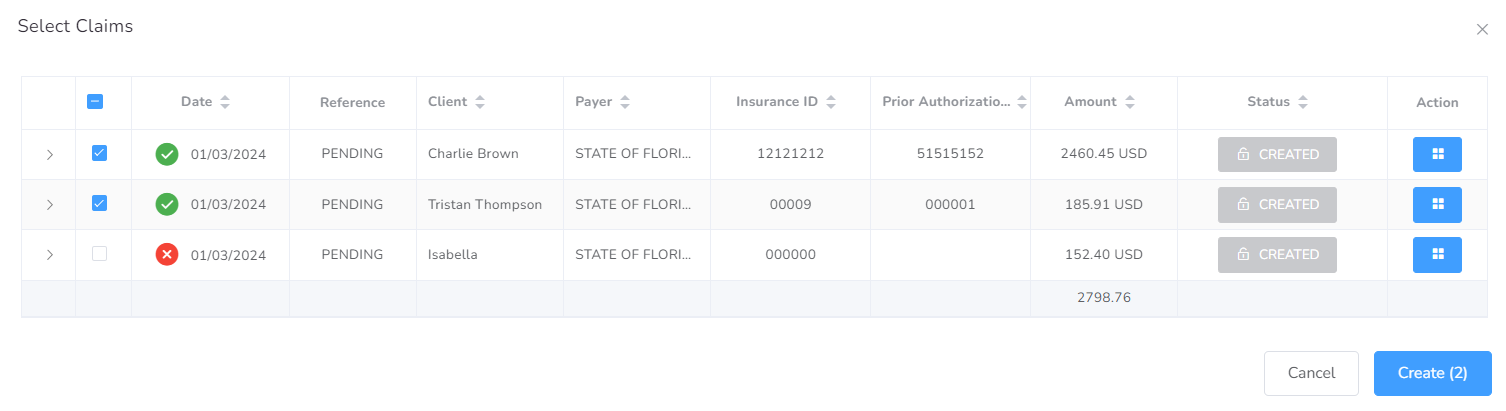

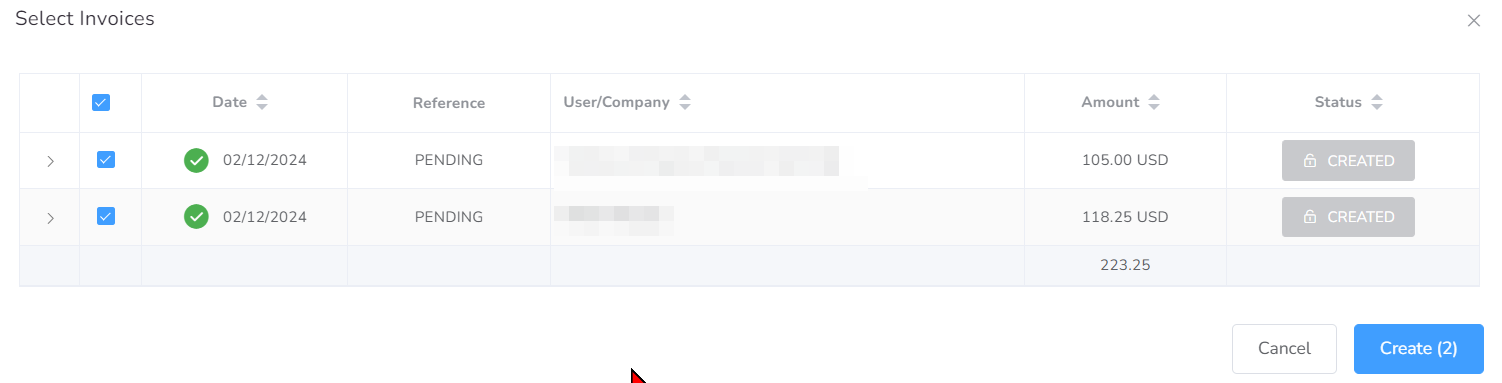

Step 13- Select the Claims to be added.

Step 14- Click on Add.

Create Batch claims

Step 1- From the Agency Dashboard, access Billing.

![]()

Step 2- Click on Batch Claims.

![]()

Step 3- Click on +New Batch.

![]()

Step 4- Select Payer.

![]()

Step 5- Select Health Plan.

![]()

Step 6- Select Clearing House (if needed/required).

Step 7- Click on Create.

![]()

Step 8- Within the batch, click on + Add claim.

![]()

Step 9- Select Other Claims / Events / Manual.

![]()

Step 10- If selected Events, then choose the Range of dates and click on Submit. Also, there are Optional filters: Providers, Credential types, Payers, Clients, Event types and Billing codes.

Step 11- Select the events to be included and hit Continue. (There you can check if there are any error on the events)

Step 12- Select Strategy: Merge all events, Split by Provider or Split by credential.

Step 13- Select the Claims to be added.

Step 14- Click on Add.

![]()

Florida SMMC Billing Updates: Streamlining BA Services for 2025

The Statewide Medicaid Managed Care (SMMC) program in Florida is transitioning to a new phase that integrates Behavior Analysis (BA) services reimbursement into managed care plans, effective February 2025. This change aims to streamline the billing and reimbursement processes for providers and health plans. Office Puzzle, as a leading SaaS platform, is dedicated to supporting providers with this transition by ensuring a seamless setup for billing and claims management.

List of Payers/Health Plans

Below is a summary of the health plans, their websites, phone numbers, and provider portals:

Payer ID: 128FL

Payer Name: AETNA

Plan Name: Aetna Better Health Florida

Website: https://www.aetnabetterhealth.com/

Phone: 786-209-5362

Provider Portal: https://medicaid.aetna.com/MWP/login.fcc

Technology Provider: AVAILITY

Managed By: https://www.bsnnet.com/

ERA Enrollment: https://providerpayments.com/Login.aspx / https://echochecks.com/

Payer ID: 68069

Payer Name: SUNSHINE

Plan Name: Children's Medical Services (CMS)

Website: https://www.sunshinehealth.com/

Phone: 866-595-8116

Provider Portal: https://provider.sunshinehealth.com/careconnect/login/oauth2/code/pingcloud&brand=sunshinehealth

Technology Provider: CENTENE

Managed By: Sunshine Health

ERA Enrollment: https://www.payspanhealth.com/nps/login.aspx

Payer ID: 68069

Payer Name: SUNSHINE

Plan Name: Sunshine Health

Website: https://www.sunshinehealth.com/

Phone: 866-595-8116

Provider Portal: https://provider.sunshinehealth.com/careconnect/login/oauth2/code/pingcloud&brand=sunshinehealth

Technology Provider: CENTENE

Managed By: Sunshine Health

ERA Enrollment: https://www.payspanhealth.com/nps/login.aspx

Payer ID: BHOVO

Payer Name: Simply Healthcare

Plan Name: Carelon Behavioral Health

Website: https://www.simplyhealthcareplans.com/florida-home/simply.html

Phone: 954-308-9410

Provider Portal: https://providerportal.carelonbehavioralhealth.com/#/login

Technology Provider: CARELON

Managed By: CARELON

ERA Enrollment: https://www.payspanhealth.com/nps/login.aspx

Payer ID: FLCCR

Payer Name: Florida Community Care

Plan Name: Florida Community Care

Website: https://fcchealthplan.com/

Phone: 786-761-4512

Provider Portal: https://secure.healthx.com/v3app/publicservice/loginv1/login.aspx?bc=16544617-390b-4625-9657-c7b235c09d3c&serviceid=df6f8096-64ea-498a-a657-7c7b407ae072

Technology Provider: MPULSE,(Accquired by ZIPARI, Acquired by HEALTHX)

Managed By: https://www.bsnnet.com/

ERA Enrollment: ????

Payer ID: 51062

Payer Name: Molina Healthcare

Plan Name: Molina Healthcare Florida

Website: https://www.molinahealthcare.com/

Phone: 305-317-3152

Provider Portal: https://provider.molinahealthcare.com/

Technology Provider: AVAILITY

Managed By: Molina Healthcare

ERA Enrollment: https://www.availity.com/

Payer ID: 65062

Payer Name: Health Network One

Plan Name: Community Care Plan (CCP)

Website: https://ccpcares.org/

Phone: 954-622-3315

Provider Portal: https://epiclink.mhs.net/planlinkCCP/common/epic_login.asp

Technology Provider: EPIC

Managed By: Health Network One

ERA Enrollment: ???

Payer ID: 61101

Payer Name: Humana

Plan Name: Humana

Website: https://www.humana.com/medicaid/florida-medicaid/member-support/behavioral-health

Phone: LTC: 803-315-0115 / MMA: 812-987-4031

Provider Portal: https://account.humana.com/

Technology Provider: AVAILITY

Managed By: AVAILITY

ERA Enrollment: https://www.availity.com/

Payer ID: 87726

Payer Name: United Healthcare

Plan Name: Optum / United Behavioral Health

Website: https://www.uhc.com/

Phone: LTC: 407-659-7258 / MMA: 407-659-7047

Provider Portal: https://uhcprovider.com/outofnetwork

Technology Provider: CHANGE HEALTHCARE

Managed By: Optum

ERA Enrollment: ???

Checklist

To ensure a seamless transition to the new SMMC billing processes, here are five key steps providers should take:

- Choose Your Clearinghouse: Evaluate and select the clearinghouse you will use for EDI submissions to ensure compatibility with your payers.

- Verify Provider Enrollment: Confirm that your practice is enrolled in all necessary health plans to avoid service disruptions.

- Review ERA Enrollment: Complete ERA (Electronic Remittance Advice) enrollments with your chosen clearinghouse and payers to streamline payment reconciliation.

- Test Claims Submission: Conduct test claims submissions with your clearinghouse and health plans to identify and resolve any potential issues early.

- Train Staff: Ensure your billing and administrative staff are familiar with the new processes, payer requirements, and portal navigation.

Clearing Houses

Office Puzzle fully supports EDI 837P (Professional Claim) transactions. This ensures seamless integration and connectivity with any clearinghouse, streamlining the submission and processing of professional healthcare claims.

If you are considering a clearing house these are the ones we typically recommend in Florida.

| PAYER NAME | PLAN NAME | PORTAL | EDI UPLOAD |

| AETNA | Aetna Better Health Florida | ❌ | ❌ |

| SUNSHINE | Children's Medical Services (CMS) | ✅ | ✅ |

| SUNSHINE | Sunshine Health | ✅ | ✅ |

| Simply Healthcare | Simply Healthcare | ❌ | ❌ |

| Florida Community Care | Florida Community Care (FCC) | ❌ | ❌ |

| Molina Healthcare | Molina Healthcare Florida | ❌ | ❌ |

| Health Network One | Community Care Plan (CCP) | ❌ | ❌ |

| Humana | Humana | ❌ | ❌ |

| United Healthcare | United Healthcare | ❌ | ❌ |

| PAYER NAME | PLAN NAME | PORTAL | EDI UPLOAD |

| AETNA | Aetna Better Health Florida | ❌ | ✅ |

| SUNSHINE | Children's Medical Services (CMS) | ✅ | ✅ |

| SUNSHINE | Sunshine Health | ✅ | ✅ |

| Simply Healthcare | Simply Healthcare | ✅ | ✅ |

| Florida Community Care | Florida Community Care (FCC) | ✅ | ✅ |

| Molina Healthcare | Molina Healthcare Florida | ✅ | ✅ |

| Health Network One | Community Care Plan (CCP) | ❌ | ✅ |

| Humana | Humana | ✅ | ✅ |

| United Healthcare | United Healthcare | ❌ | ✅ |

| PAYER NAME | PLAN NAME | PORTAL | EDI UPLOAD |

| AETNA | Aetna Better Health Florida | ✅ | ✅ |

| SUNSHINE | Children's Medical Services (CMS) | ✅ | ✅ |

| SUNSHINE | Sunshine Health | ✅ | ✅ |

| Simply Healthcare | Simply Healthcare | ✅ | ✅ |

| Florida Community Care | Florida Community Care (FCC) | ✅ | ✅ |

| Molina Healthcare | Molina Healthcare Florida | ✅ | ✅ |

| Health Network One | Community Care Plan (CCP) | ✅ | ✅ |

| Humana | Humana | ✅ | ✅ |

| United Healthcare | United Healthcare | ✅ | ✅ |

| PAYER NAME | PLAN NAME | PORTAL | EDI UPLOAD |

| AETNA | Aetna Better Health Florida | ✅ | ✅ |

| SUNSHINE | Children's Medical Services (CMS) | ✅ | ✅ |

| SUNSHINE | Sunshine Health | ✅ | ✅ |

| Simply Healthcare | Simply Healthcare | ✅ | ✅ |

| Florida Community Care | Florida Community Care (FCC) | ✅ | ✅ |

| Molina Healthcare | Molina Healthcare Florida | ✅ | ✅ |

| Health Network One | Community Care Plan (CCP) | ✅ | ✅ |

| Humana | Humana | ✅ | ✅ |

| United Healthcare | United Healthcare | ✅ | ✅ |

Get Ready!

Office Puzzle is fully committed to ensuring that all configurations and integrations with health plans are finalized before the February 2025 implementation of the new SMMC program. We will provide another detailed announcement with further guidance and updates as the transition date approaches. Our team is here to support your billing needs, ensuring a seamless and efficient workflow.

Stay tuned for more updates, and do not hesitate to reach out with any questions or concerns!

Compliance Trust Badges: Ensuring Data Security & Regulatory Adherence

At Office Puzzle, we prioritize the security and privacy of our users’ data. As a proof of our commitment, we continue holding our Compliance Trust Badges, showcasing our dedication to upholding the highest standards of regulatory compliance. By partnering with Compliancy Group through its program "The Guard," we maintain and monitor compliance with HIPAA, OSHA, & SOC2, ensuring that your sensitive information is protected at all times.

What you should know about HIPAA, OSHA, and SOC 2?

- HIPAA (Health Insurance Portability and Accountability Act): A U.S. law enacted in 1996 to protect sensitive patient health information from being disclosed without the patient's consent or knowledge. It ensures the privacy, security, and confidentiality of healthcare data, and applies to healthcare providers, insurers, and any business that handles protected health information (PHI).

- OSHA (Occupational Safety and Health Administration): A federal agency under the U.S. Department of Labor, responsible for ensuring safe and healthy working conditions for employees by setting and enforcing standards and providing training, education, and assistance. OSHA regulations cover various industries, including healthcare, to prevent workplace injuries, illnesses, and deaths.

- SOC 2 (System and Organization Controls 2): A set of standards developed by the American Institute of Certified Public Accountants (AICPA) for evaluating and reporting on the security, availability, processing integrity, confidentiality, and privacy of a service organization's systems. SOC 2 compliance is critical for businesses that handle sensitive customer data, particularly in the technology and cloud computing industries.

Why HIPAA Compliance Matters?

For companies like Office Puzzle, operating within healthcare and therapy management, HIPAA compliance is non-negotiable. HIPAA regulations are designed to protect the sensitive personal identifiable health information of patients, ensuring confidentiality, integrity, and security. By keeping the HIPAA Trust Badge, Office Puzzle demonstrates our proactive efforts in securing the data, aligning with best practices for health information management.

The Trust Badge system provides transparency for website visitors, showcasing how we actively monitor and maintain compliance with HIPAA and other essential regulatory frameworks. The active date stamping ensures that at any point in time, our monitoring is up-to-date and our commitment to compliance is ongoing. This badge is a visible emblem of our commitment to maintaining compliance with key regulations, including HIPAA (Health Insurance Portability and Accountability Act), OSHA (Occupational Safety and Health Administration), and SOC 2 (System and Organization Controls 2), offering website visitors clear assurance that Office Puzzle operates with stringent compliance standards, further enhanced by active date stamping.

Our team is committed to making compliance a seamless part of our operations. The HIPAA Trust Badge, along with OSHA and SOC 2 badges, solidifies our place as a trusted provider in the industry. Through our partnership with Compliancy Group, we efficiently manage compliance with various regulatory requirements, ensuring that updates or changes in regulations are quickly integrated into our processes, allowing us to focus on what we do best—providing innovative software solutions for therapy providers.

Rate Changes for Medicaid in Florida

Important Update: Rate Changes for Medicaid in Florida

As you may have heard, the State of Florida is implementing changes to the Medicaid health plan rates effective October 1st, 2024. While we received this news with less than 3 days’ notice, let’s look on the bright side—after all, higher rates mean more funding to support our vital services! It’s almost like getting a surprise party, but instead of cake, we get… rates!

At Office Puzzle, we want to make sure you have the tools you need to navigate this transition smoothly.

We recommend a straightforward approach: only change the rates once you have finalized billing for the previous month, which includes everything up until September 30th.

And if you’re thinking about updating the rates early, here’s the funny part: even if you do it today, Medicaid won’t pay you the higher rate just yet! So if you want, you can update the rates right now and you will be fine. They will adjust to the correct rates.

To avoid any issues, check out our step-by-step guide on how to manually update your rates by following the instructions below or the quick video tutorial we’ll be providing. This will ensure everything runs smoothly without any surprises!

- Go to the Agency Dashboard

- Click Configuration

- Click Billing

- Click Payers

- Click on the Payer Name (STATE OF FLORIDA, MEDICAID, FLORIDA MEDICAID, etc)

- Look for the Health Plan, it's on the right. Click on the green pencil right next to the name of the Health Plan (Default, Medicaid, etc)

- Click the Rates Tab

- Find the Billing code you would like to update the rate and enter the new amount (find the changes below)

- Repeat step #8 three times since we have 3 rate changes (97153, 97155, 97155-HN)

The video instruction is here:

In case you missed the changes here is a quick summary of them:

| Service Description | Procedure Code | 2022 Rate (Per Unit) | 2022 Rate (Per Hour) | 2024 Rate (Per Unit) | 2024 Rate (Per Hour) | Fee Change (Per Unit) | Fee Change (Per Hour) |

|---|---|---|---|---|---|---|---|

| Behavior identification - assessment | 97151 | $19.05 | $76.20 | $19.05 | $76.20 | No change | No change |

| Behavior identification - supporting assessment | 97152 | $12.19 | $48.76 | $12.19 | $48.76 | No change | No change |

| Behavior reassessment | 97151 TS | $12.19 | $76.20 | $12.19 | $48.76 | No change | No change |

| Behavior treatment with protocol modification (Lead) | 97155 | $19.05 | $76.20 | $19.17 | $76.68 | +$0.12 | +$0.48 |

| Behavior treatment with protocol modification (Assistant) | 97155 HN | $15.24 | $60.96 | $15.37 | $61.48 | +$0.13 | +$0.52 |

| Behavior treatment by protocol (RBT/BCaBA/Lead) | 97153 | $12.19 | $48.76 | $12.26 | $49.04 | +$0.07 | +$0.28 |

| Family training by Lead Analyst | 97156 | $19.05 | $76.20 | $19.05 | $76.20 | No change | No change |

| Family training via telemedicine (Lead Analyst) | 97156 GT | $19.05 | $76.20 | $19.05 | $76.68 | No change | No change |

| Family training by assistant | 97156 HN | $15.24 | $60.96 | $15.24 | $60.96 | No change | No change |

Thank you for your continued partnership as we work together through these changes!

Payments & Invoice Efficient Integration

Name: Creating and Managing Invoices on the Agency’s Payment section at Office Puzzle

Description: How to create an invoice on the Agency’s Payment section.

Difficulty: Middle

Duration: Less than 10 minutes

Invoices

Summary:

Step 1- From the Agency Dashboard, access Payments shortcut.

Step 2- Click on Invoices.

Step 3- Click on +New invoice.

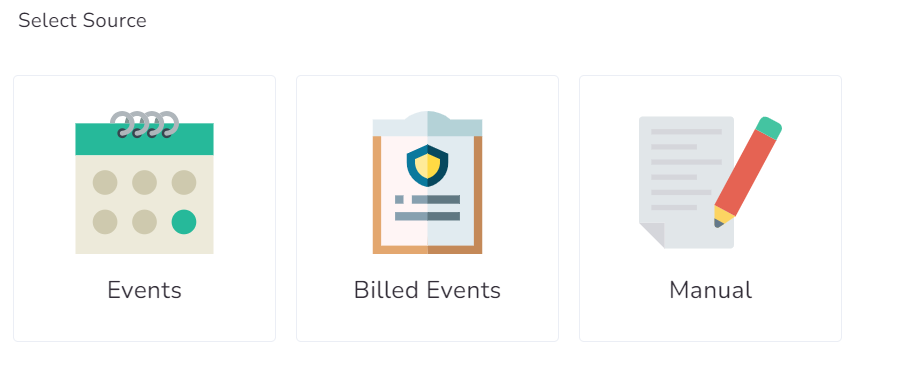

Step 4- Select Source: Events, Billed Events or Manual.

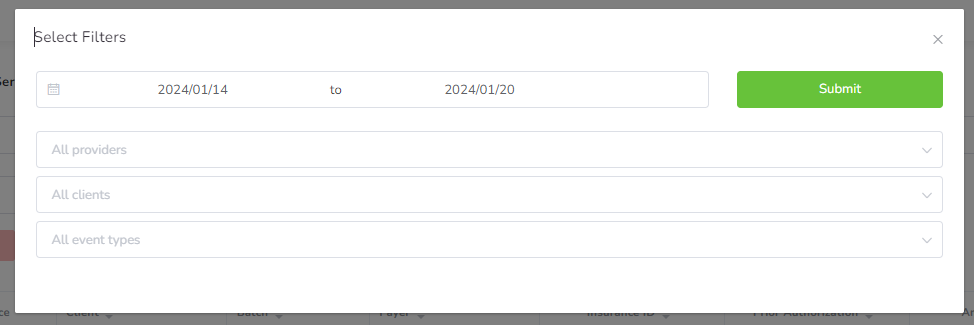

Step 5- If selected Events/Billed events, then choose the Range of dates and click on Submit. Also, there are Optional filters: Providers, Clients and Event types.

Step 6- Select the events to be included and hit Continue. (There you can check if there are any error on the events)

Step 7- Select Strategy: Merge all Events, Split by Provider or Split by Event Type.

Step 8- Select the Invoices to be created.

Step 9- Click on Create.

Create Invoices on the Agency’s Payments section

Invoices

Step 1: Navigate to the Agency Dashboard and access the Payments shortcut.

Step 2: Click on the "Invoices" box.

Step 3: Initiate a new invoice by clicking on "+New Invoice."

Step 4: Choose the source of the invoice: Events, Billed Events, or Manual.

Step 5: If Events/Billed Events is selected, specify the date range and click "Submit." Optional filters such as Providers, Clients, and Event types can be applied.

Step 6: Select the events to be included in the invoice and proceed by clicking "Continue." This step also allows you to check for any errors in the selected events.

Step 7: Opt for a strategy to organize the invoice: Merge all Events, Split by Provider, or Split by Event Type.

Step 8: Choose the specific invoices you want to create.

Step 9: Finalize the process by clicking "Create."

![]()

Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA)

Multi-Factor Authentication (MFA) is a security mechanism that requires users to provide two or more different authentication factors to verify their identity, this adds an extra layer of protection beyond traditional username and password combinations.

Multi-Factor Authentication (MFA) gained significant popularity in the late 2000s and early 2010s as online security threats escalated. With the proliferation of cyberattacks, including phishing, credential stuffing, and data breaches, traditional single-factor authentication methods like passwords have become increasingly vulnerable. MFA emerged as a robust solution to mitigate these risks by adding an extra layer of security. It gained further momentum as businesses and individuals recognized the importance of protecting sensitive data and accounts. The widespread adoption of smartphones and the availability of authentication apps also contributed to its popularity, providing convenient and reliable methods for implementing MFA. Today, MFA is considered a fundamental security measure for safeguarding digital identities, securing online transactions, and protecting against unauthorized access.

Types of MFA

There are several types of Multi-Factor Authentication (MFA), each utilizing different combinations of authentication factors to verify a user's identity. Here are some common types:

- SMS-based MFA: This method involves sending a one-time code to the user's mobile phone via text message. The user must enter this code along with their password to complete the authentication process.

- Time-based One-Time Passwords (TOTP): Similar to authentication apps, TOTP generates one-time codes based on the current time and a shared secret between the service provider and the user.

- Email-based MFA: Sends a one-time code or a link via email for the user to confirm their identity. The user must enter this code along with their password to complete the authentication process.

- Hardware Tokens: Physical devices, such as key fobs or smart cards, generate unique codes that users input during login. These tokens can be standalone devices or integrated into other objects like USB keys.

- Biometric Authentication: This method involves using unique biological characteristics, such as fingerprints, facial recognition, or iris scans, to verify a user's identity.

- Push Notification MFA: When users attempt to log in, a push notification is sent to their registered device. They can approve or deny the login attempt directly from the notification.

Each type of MFA has its advantages and disadvantages in terms of security, usability, and implementation complexity, and the choice often depends on the specific requirements and preferences of the organization or individual implementing it.

At Office Puzzle, we're proud to announce our implementation of Email, SMS, and Time-based One-Time Passwords (TOTP) support. This addition marks a significant stride in fortifying our platform's security and safeguarding the productivity of our users.

A Step-by-Step Guide to Evaluate Objectives

Evaluating objectives is a crucial step in managing and organizing Short Term Objectives (STOs) within the Office Puzzle system. This tutorial will guide you through the process of adding mastered dates for STOs by utilizing the “Evaluate Objectives” functionality. By following these steps, you'll be able to efficiently set and manage key dates associated with your objectives.

- Step 1: Navigate to the client's Dashboard.

- Step 2: Locate and click on the “Data” shortcut.

- Step 3: Within the Data section, find and click on the “Datasheets” option.

- Step 4: On the Datasheets page, look for the prominently displayed “Bulk Actions” button. Click on this button to access a dropdown list containing several options for managing your objectives.

- Step 5: From the dropdown list, choose the “Evaluate Objectives” option.

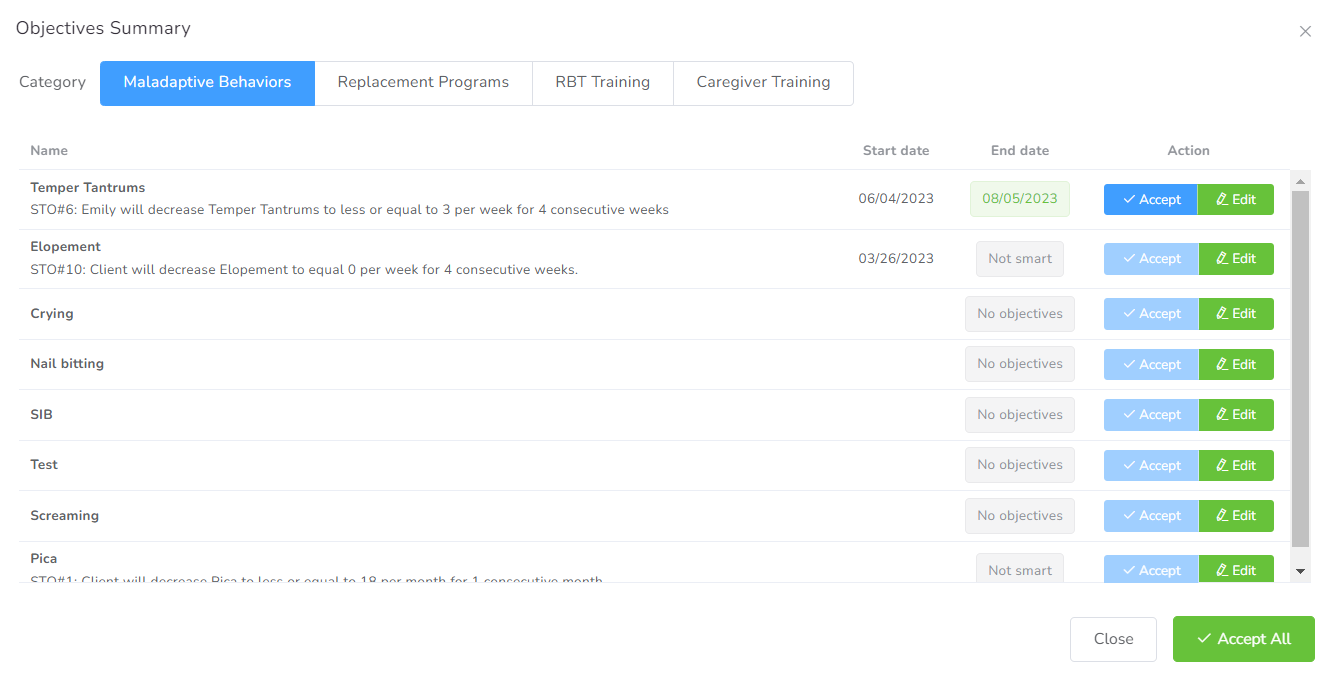

- Step 6: Upon selecting Evaluate Objectives, a table will display various categories and items related to your objectives. This table includes information about the objectives, along with the proposed mastered dates.

Step 7: In the table, you will see the option to either “Accept” the suggested mastered date or “Edit” it as needed. Evaluate each objective and decide the appropriate action based on your requirements.

Step 7: In the table, you will see the option to either “Accept” the suggested mastered date or “Edit” it as needed. Evaluate each objective and decide the appropriate action based on your requirements.

By following these steps, you can efficiently evaluate objectives and manage mastered dates for STOs in the Office Puzzle system. This functionality streamlines the process of setting key dates, ensuring that your objectives align with your client's progress. Make use of the Evaluate Objectives feature to enhance your workflow and keep your Objectives on track.

Importance of Swift Billing & Payment Collection for ABA Providers

In the realm of Applied Behavior Analysis (ABA), where dedicated professionals work tirelessly to provide essential services to individuals with autism and other developmental disorders, efficient financial management often takes a backseat. However, it's crucial for ABA providers to recognize the vital role that swift billing and payment collection play in enhancing cash flow and overall profitability. Let's delve into why this aspect deserves our utmost attention.

- Timely Billing Reduces Revenue Lag:

The ABA industry typically operates on a billing cycle basis, with services rendered today often invoiced at a later date. This can lead to a considerable lag between service delivery and revenue recognition. By promptly submitting claims and bills to insurance agencies, ABA providers can significantly reduce this revenue lag, ensuring a more predictable cash flow.

- Minimizing Payment Delays:

Insurance agencies have their own processes and timelines for evaluating claims and disbursing payments. Delays in billing or incomplete submissions can exacerbate these delays, affecting your organization's ability to cover operational expenses, pay staff, and invest in growth. Timely billing helps minimize these payment delays, ensuring that funds are available when needed.

- Mitigating Denials and Rejections:

Insurance claims are subject to a host of regulations and requirements. Failing to bill accurately and promptly can result in claim denials or rejections, which not only hinder cash flow but also demand additional administrative effort to rectify. By submitting clean, error-free claims on time, ABA providers can reduce the likelihood of denials and rejections.

- Enhanced Financial Stability:

A steady cash flow derived from swift billing and payment collection contributes to the financial stability of ABA providers. It ensures that you have the funds to cover operating costs, invest in technology and training, and expand your services to meet growing demand.

- Improved Profitability and Growth Opportunities:

Ultimately, the impact of timely billing and payment collection is reflected in the bottom line. ABA providers who prioritize these processes experience better profitability, which can be reinvested into the business to improve service quality, expand reach, or offer more comprehensive care options.

- Client Satisfaction:

A less obvious benefit is the positive impact on client satisfaction. When ABA providers have stable finances and can dedicate more time to their clients, it fosters a better overall experience. Clients can focus on progress and positive outcomes, rather than potential disruptions caused by financial instability.

- Office Puzzle Billing Feature with Clearing House Integration:

One effective way to achieve swift billing and payment collection is by leveraging advanced software solutions tailored to the healthcare industry. Office management systems like Office Puzzle, with integrated clearing house capabilities, can significantly streamline the billing process. These solutions:

- Automatically generate and submit claims to insurance agencies, reducing manual data entry errors and saving time. [Reference: Healthcare IT News - "The Benefits of Integrated Billing Solutions”]

- Provide real-time status updates on claims, helping ABA providers track the progress of their submissions. [Reference: Medical Economics - "Why Real-time Claims Processing Matters”]

- Identify potential errors or discrepancies in claims before submission, minimizing the risk of denials. [Reference: RevCycleIntelligence - “How Integrated Revenue Cycle Management Prevents Billing Errors”]

- Integrate with insurance companies' systems, facilitating faster payment processing and reducing payment delays. [Reference: Journal of AHIMA - "The Role of Clearinghouses in Revenue Cycle Management”]

In conclusion, the importance of swift billing and payment collection for ABA providers cannot be overstated. It's not just about financial management; it's about ensuring that your organization can continue to provide high-quality care and grow sustainably. By embracing efficient billing practices, ABA providers can secure their financial health while making a positive impact on the lives of the individuals they serve. Integrated office management solutions like Office Puzzle play a pivotal role in achieving these goals.

Understanding 835 and 837 files in Billing

The healthcare industry relies heavily on accurate and efficient billing processes to ensure the smooth flow of financial transactions between providers and payers. Two essential components of this process are the 835 and 837 files. These files play a crucial role in healthcare claims and remittance. In this article, we will explore what 835 and 837 files are, how they work, and their significance in the healthcare billing process.

What is an 837 File?

An 837 file is an electronic claim submission document used by healthcare providers to submit claims for reimbursement to payers. It contains comprehensive information about the services provided to patients, along with associated diagnosis and procedure codes. The 837 file is the format in which providers send billing information to payers electronically.

Key components of an 837 file include:

- Patient Information: Demographic details of the patient, such as name, date of birth, and insurance information.

- Provider Information: Information about the healthcare provider, including their NPI and contact details.

- Service Details: Descriptions of the services rendered, including CPT (Current Procedural Terminology) codes and ICD-10 (International Classification of Diseases, 10th Edition) diagnosis codes.

- Payer Information: Details about the insurance payer responsible for processing the claim.

- Claim Totals: Summaries of the charges, payments, and adjustments related to the claim.

Once the healthcare provider submits the 837 file to the payer, the payer processes the claim, which may result in the creation of an 835 file that provides information on the payment and any adjustments made.

What is an 835 File?

An 835 file, often referred to as an Electronic Remittance Advice (ERA), is an electronic document that provides detailed information about the payments and adjustments made by a healthcare payer (such as an insurance company or Medicare) to a healthcare provider. Essentially, it serves as a remittance advice that explains how a claim was processed and paid. Key information contained in an 835 file includes:

- Payment Details: This section includes the payment amount, payment method (e.g., electronic funds transfer), and payment date.

- Claim Information: It provides data related to the specific claim being paid, such as the claim number, patient information, and service details.

- Adjustments and Denials: Any adjustments or denials made to the claim are documented in this section. It explains why certain services were not covered or were partially paid.

- Provider Information: Details about the healthcare provider receiving the payment, including their name, National Provider Identifier (NPI), and address.

- Payer Information: Information about the healthcare payer responsible for processing the claim, including their name, payer ID, and contact information.

The 835 file is crucial for healthcare providers to reconcile their accounts receivable, understand the payment rationale, and address any discrepancies in payments.

The Relationship Between 835 and 837 Files

The 835 and 837 files are interconnected in the healthcare billing process. Here's how they work together:

- Claim Submission: Healthcare providers use the 837 file to submit claims electronically to payers.

- Claim Processing: Payers receive the 837 file, process the claim, and determine the appropriate reimbursement.

- 835 Generation: If the claim is approved, the payer generates an 835 file, which is sent back to the provider. This 835 file explains how the claim was processed and the payment details.

- Reconciliation: Healthcare providers use the information in the 835 file to reconcile their accounts and ensure they received the correct payment for services rendered.

- Resolution: If there are discrepancies or denials, providers can use the information in the 835 file to address these issues with the payer.

Office Puzzle ensures that agencies comply with HIPAA requirements while optimizing their billing management. One of the features of our platform specializes in the creation of 837 files and the ability to upload 835 files to the platform in the raw. The system identifies claims and batch issues that can hinder payment accuracy, as well as prevents specific denial issues.