In the world of healthcare and therapeutic services, agencies providing Applied Behavior Analysis (ABA), Mental Health, Occupational, and Speech Therapy play a crucial role in enhancing the well-being of individuals. However, behind the scenes, there is an intricate web of compliance requirements, especially when it comes to managing payments for independent contractors. In this blog post, we will explore the compliance landscape for these providers and discuss how the payments feature of Office Puzzle can serve as a valuable tool for maintaining accurate records and simplifying the 1099 filing process.

Understanding Compliance for Independent Contractors:

For organizations in this field, compliance is not just a buzzword; it is a critical aspect of operations. Independent contractors, often engaged by these enterprises, require meticulous management to ensure adherence to tax regulations. The IRS Form 1099 is a key document in this process, serving as a record of payments made to subcontracted providers during the fiscal year.

Challenges Faced by Agencies:

Varied Payment Structures: Independent contractors may receive payments based on hourly rates, sessions conducted, or specific services provided. Tracking these diverse payment structures can be challenging without a centralized system.

Record Keeping: Keeping accurate records of payments made to independent contractors is not only a compliance necessity but also crucial for financial transparency and accountability.

IRS Form 1099 Filings: Filing 1099s accurately and on time is a legal requirement, and any discrepancies may lead to penalties and legal ramifications.

Office Puzzle‘s Payments Feature: A Compliance Solution

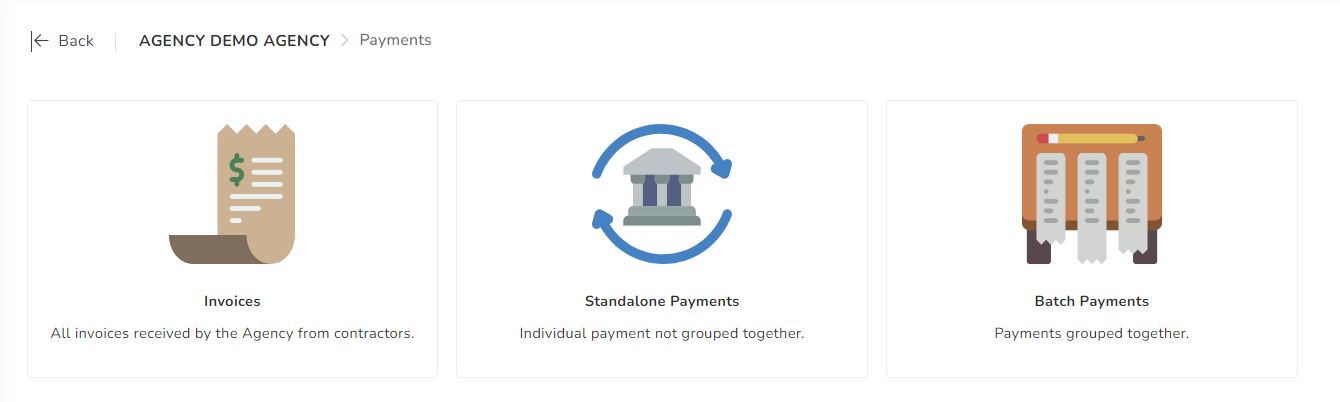

Office Puzzle, a comprehensive office management tool, offers a specialized Payments feature designed to address the unique needs of these organizations.

Streamlining Payment Processes

Streamlining Payment Processes

The Payments feature allows agencies to record invoices derived from the services provided by the independent contractors. Invoices created and recorded in Office Puzzle can be linked to events or visits previously recorded in the system, allowing the organization to categorize and track payments to independent contractors seamlessly. The system will automatically add details such as date and amount and allow users to input payment details, ensuring a centralized and easily accessible record of all transactions.

1099 Reporting

One of the standout features of Office Puzzle is its ability to generate payments reports that contain all the data required for the preparation of 1099 reports. By inputting payments made throughout the year, agencies can effortlessly generate accurate reports needed to prepare 1099 forms for their independent contractors come tax season. This significantly reduces the administrative burden and minimizes the risk of errors in the process.

Secure and Compliant

Security is paramount when dealing with sensitive financial information. Office Puzzle employs robust security measures to safeguard payment data, ensuring compliance with privacy regulations and instilling confidence in agencies and independent contractors alike.

Conclusion

In the fast-paced world of healthcare and therapy services, agencies must embrace tools that not only enhance operational efficiency but also ensure compliance with ever-evolving regulations. The Payments feature of Office Puzzle emerges as a valuable ally for agencies offering a streamlined solution to manage payments, maintain accurate records, and simplify the often-daunting task of 1099 filing for independent contractors.

As agencies navigate the complex landscape of compliance, understanding the IRS regulations governing 1099 reporting is essential. The IRS provides comprehensive information on Form 1099 reporting on their official website. For detailed guidance on filing requirements, deadlines, and other pertinent information, you can refer to the IRS Form 1099 General Instructions available here.

Having a dependable partner like Office Puzzle can make all the difference in fostering success and sustainability. By combining the convenience of modern technology with a commitment to compliance, agencies can confidently navigate the intricacies of payment management and ensure seamless 1099 reporting when tax season arrives.